Как делать ставки в БК Pin-Up?

Регистрация и верификация личности в букмекерской конторе Pin-Up, а также процедура пополнения лицевого счёта – это лишь подготовка к самому важному. Каждый беттор с нетерпением ждёт возможности сделать свою первую ставку, найти оптимальное событие с «сочным» коэффициентом. И на некоторых сайтах новый пользователь может банально заплутать, запутаться в огромном количестве вкладок и разделов. Но клиенту букмекерской конторы Pin-Up такая опасность не грозит, поскольку ресурс максимально удобный и комфортный.

БК Ivanbet (Pin-Up) прекратила деятельность на территории страны

Рекомендуем ознакомиться с актуальным списком лучших лицензионных БК страны, доступных для работы, в нашем рейтинге рейтинге

Начало работы с БК

Но, прежде чем перейти непосредственно к процессу ставок, необходимо подготовить платформу для этого, а именно – создать на сайте букмекера личный кабинет и депозит. Начинается все, конечно, с регистрации.

Регистрация в БК Pin-Up

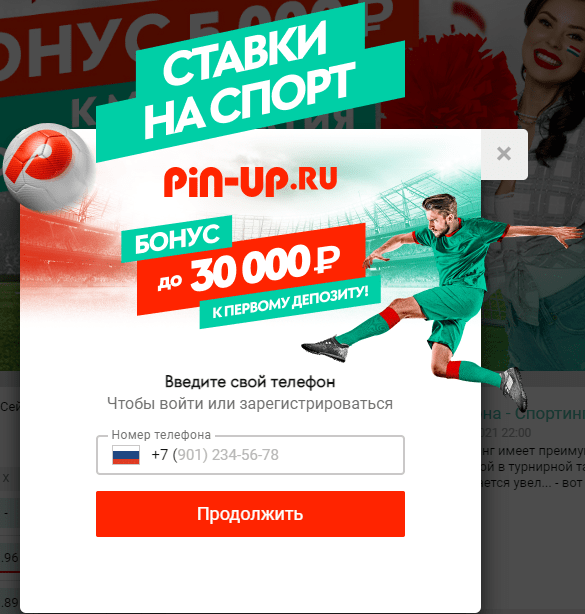

Для регистрации на сайте букмекерской конторы перейти туда по кнопке ниже.

В верхнем правом углу главной страницы сайта найдите красную кнопку «Регистрация» и нажмите на нее для перехода в регистрационную форму.

На первом этапе достаточно будет указать только номер телефона, на который поступит код подтверждения, необходимый для перехода к последующим шагам.

Также в процессе регистрации потребуется действующий адрес вашей электронной почты, а также подтверждение того, что вам есть 18 лет и вы ознакомились с правилами букмекера.

Идентификация аккаунта

БК Пин-Ап входит в ЦУПИС Киви-банка, а потому, пользователи, в распоряжении которых есть идентифицированный Qiwi-кошелек могут просто указать его номер при регистрации, избежав необходимости повторно проходить верификацию.

Если же у вас нет такого кошелька – он будет создан в процессе регистрации, а идентифицировать аккаунт можно будет непосредственно на сайте букмекера. Сделать это можно с помощью следующих способов:

- Загрузить на сайт компании сканы или фото паспорта, в специальный раздел личного кабинета;

- Пройти идентификацию через Госуслуги (по ссылке с сайте БК);

- Пройти офлайн-верификацию, посетив с паспортом и телефоном салон Связной или CONTACT.

Идентификация является обязательным условием начала работы с любым легальным букмекером, в число которых входит и Pin-Up.

Пополнение счета

Далее останется только пополнить счет, создав, таким образом свой первый депозит (и получив за него приветственный бонус).

БК Пин-Ап позволяет пополнить счет множеством способов, в число которых, конечно, входят, банковские платежные карты, электронные кошельки (Qiwi, ЮMoney, WebMoney), а также мобильные платежи и системы интернет-банкинга.

Вывод средств

Забегая вперед, скажем, что выводить средства со счета можно теми же способами, которыми ранее было осуществлено пополнение, т.к. внесение средств на депозит означает привязку платежного средства к личному кабинету.

Ставки в БК Pin-Up

Процесс ставки займёт считанные минуты, но к нему важно подойти максимально ответственно. Только так можно заключить пари, которое принесёт достойную прибыль. Условно процесс ставки можно разбить на несколько важных этапов:

- Поиск оптимального события;

- Выбор лучшего исхода;

- Оформление пари.

Каждый шаг представляет особенную важность, поэтому и рассматривать их нужно по отдельности.

Поиск лучшего события для ставки

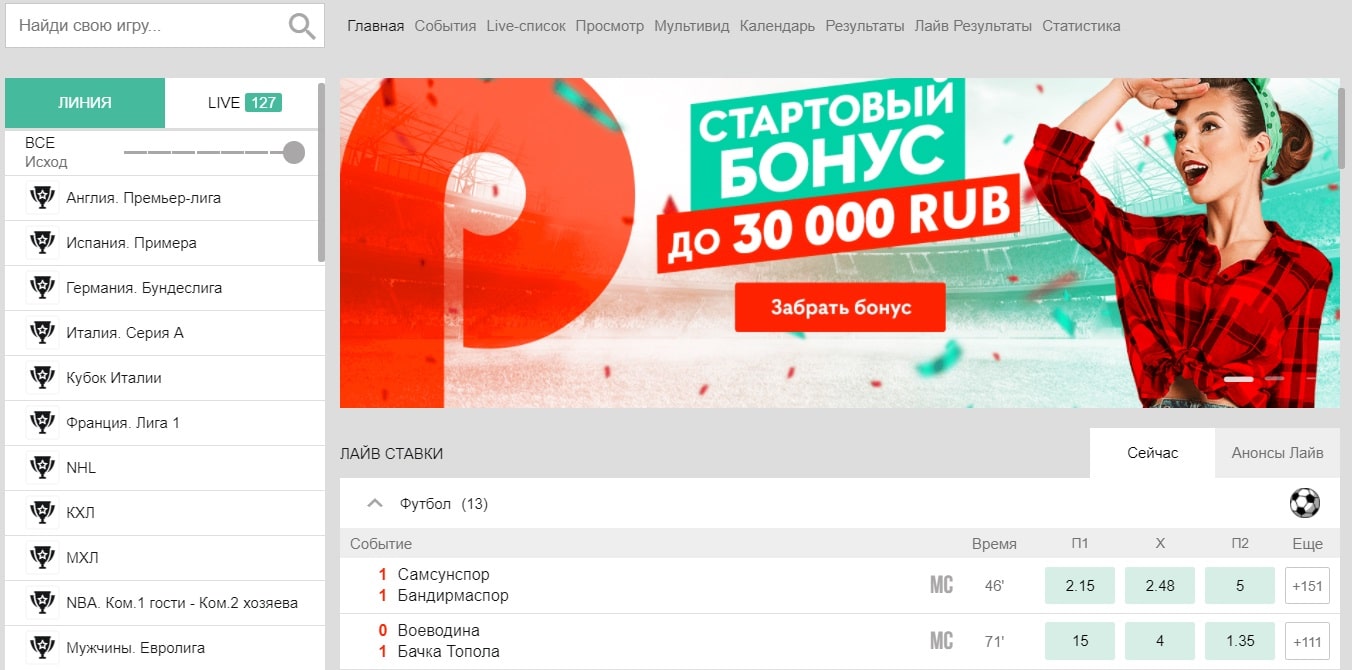

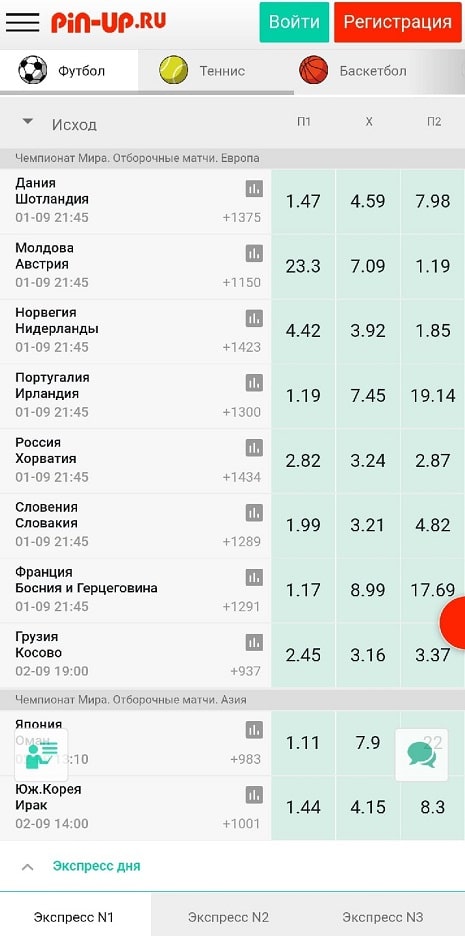

Стоит отметить, что сайт букмекерской конторы Pin-Up практически идеально рассчитан под быстрое совершение ставок. На главной странице пользователя моментально встречают разделы «Ставки на спорт», «Live» и «Киберспорт». Последнему уделяется особенное внимание, поэтому и найти любое интересующее событие можно в несколько кликов.

Отдельным преимуществом букмекерской конторы Pin-Up является то, что рекламные виджеты занимают минимальное пространство, не отвлекают пользователя от линии (расположена в левой части экрана) и live-ставок (нашли свой место прямо под баннерами).

Отдельно стоит отметить наличие быстрого поиска – по названию команды или имени участника (в индивидуальных видах спорта) можно практически моментально перейти на страницу события. Остальные события отсортированы по популярности, поэтому искать NBA и NHL среди чемпионатов Уганды и Конго точно не придётся. Лайв ставки также можно найти прямо на главной странице – они структурированы по видам спорта.

Поиск подходящего исхода

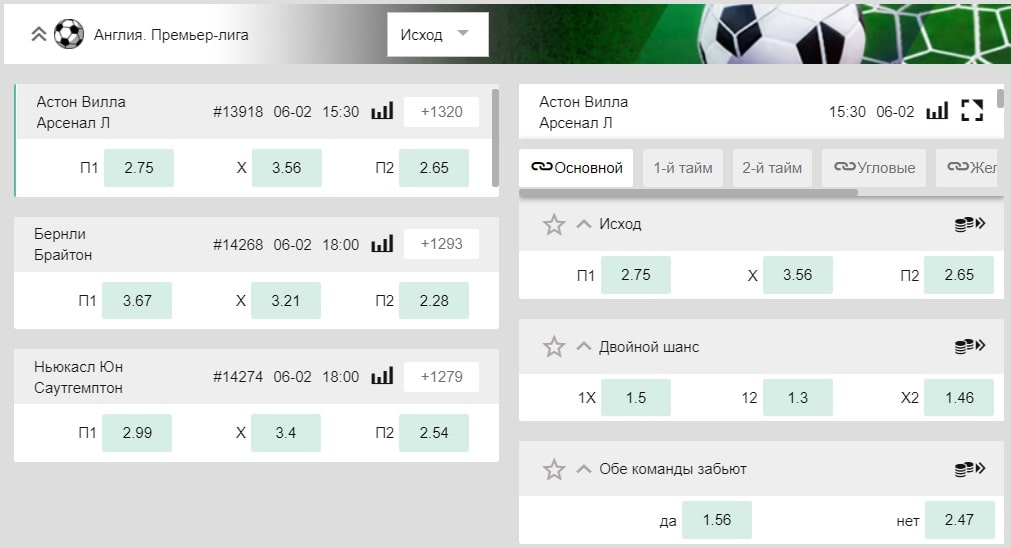

Поиск исхода также может стать непростой задачей для любого любителя ставок. После выбора события полная роспись появляется в соседнем окошке. Что любопытно, пользователь имеет возможность параллельно продолжать наблюдение за коэффициентами, которые букмекер выставил на остальные поединки.

Следующим важным моментом является расположение исходов. Они довольно удачно расставлены, основные предшествуют дополнительным. Более того, исходы следуют друг за другом по игровым отрезкам (таймам, периодам), что также не позволяет запутаться, помогает прийти к цели.

Анализ должен стать ключевым шагом, поэтому к нему нужно подойти максимально ответственно. Недостаточно просто посмотреть статистику личных встреч и последние результаты. Желательно найти информацию о кадровом состоянии коллективов (травмы, дисквалификации). Ещё одним важным моментом станет поиск новостей (скандалы внутри команды, кризис лидеров).

После этого можно выбирать отдельный исход. Рассмотреть процедуру можно на примере матча «Ливерпуль – Манчестер Сити». Встречаются две самые яркие команды английской Премьер-лиги, которые сражаются за чемпионский титул. Поэтому довольно тяжело рассчитывать на то, что каждый из коллективов не забьёт хотя бы по голу. Более того, Манчестер Сити выдал серию из 13 побед подряд во всех турнирах. Поэтому рассчитывать на поражение «горожан» не приходится.

На основе приведённого анализа можно составить целый перечень возможных исходов:

- Обе забьют – да;

- Тотал больше 2,5;

- Фора (0) на гостей;

- П2 + обе забьют – да.

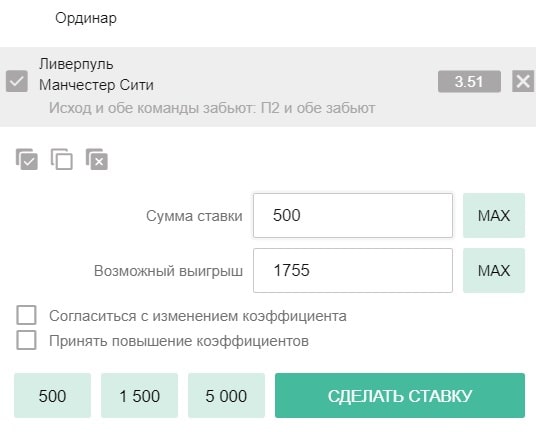

Чтобы получить самый мощный коэффициент можно сделать комбинированную ставку. Поставить на победу Манчестер Сити и голы от каждой из команд можно за 3.51.

Ставка на спортивное событие

После выбора оптимального исхода он добавляется в билет – данная вкладка моментально открывается в правой части экрана. Пользователь может настроить быструю ставку, тогда при нажатии на коэффициент пари будет заключаться автоматически. Но чтобы обезопасить себя от случайных ставок, лучше заниматься этим процессом вручную.

Пользователю остаётся лишь выбрать сумму ставки (кроме того, есть возможность моментально установить максимальную, в один клик). Система подсчитывает возможный выигрыш, чтобы беттор сразу понимал масштабы возможной победы. После этого нажимается кнопка «Сделать ставку» и пользователь получает заветный купон, с которым ему остаётся лишь дождаться окончания события. С экспрессом и системой алгоритм абсолютно схож, но требуется добавить несколько матчей, а затем повторить все перечисленные выше действия.

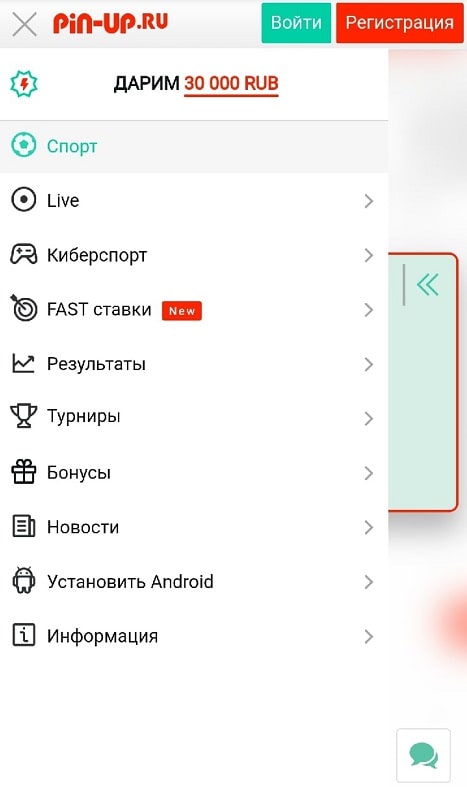

Как ставить через мобильное приложение?

Ставки через мобильную версию и приложение БК Pin-Up ничем не отличаются от работы с БК через полную версию сайта. Интерфейс приложений максимально адаптирован к сайту БК, с тем лишь исключением, что его предварительно необходимо скачать на свой смартфон. Сделать это можно в специальном разделе сайта БК.

Что касается ставок на мобильном сайте Пин-Ап – линия БК находится в разделе «Спорт», а добавление событий в купон ставки осуществляется путем нажатия на коэффициент.

Частые вопросы

Несколько вопросов, касающихся процесса ставок в Pin-Up.

Как сделать ставку фрибетом?

Всем новым клиентам букмекер дарит бонус в размере до 30000 рублей. Это не бездепозитный фрибет-бонус, т.к. он подразумевает удвоение депозита, но зато его размер может достигать рекордных, относительно других компаний, величин. Для ставки на полученный бонус выберите его в купоне перед подтверждением пари.

Можно ли делать ставки без регистрации?

Нет, ставить в БК Pin-Up, как и в любой другой легальной букмекерской компании можно только после прохождения процедур регистрации и идентификации.

На что ставить в БК Pin-Up?

Компания отличается, может, не рекордной, но очень широкой линией ставок, в которой представлены все, востребованные у бетторов, виды спорта, так что вы можете выбрать любую, подходящую вам дисциплину.

Вывод

Букмекерская контора Pin-Up максимально позаботилась о пользователях. Она предлагает максимально эргономичный дизайн, а любую ставку можно заключить в несколько кликов. А вот заключить выигрышное пари – более сложная задача. Но сайт IronBets всегда готов прийти на помощь и выручить в трудную минуту. На страницах можно найти стратегии игры, полезные советы и даже готовые прогнозы на спортивные события.

С уважением, Сергей Рождественский (ironbets.ru)

Dark Dome is an indie game studio based in Peru. It was founded in 2019 by Aldo Mujica and Sandro de la Riva Aguero.

Downloadable in Google Play

Викторина стартует в обед в понедельник. У вас есть целый день, чтобы дать правильные ответы. Особенность мероприятия в том, что администрация подготавливает интересные вопросы из мира спорта. Так что фанатов футбола, баскетбола, хоккея и других спортивных дисциплин ждут каверзные вопросы и щедрые бонусы за правильные ответы.

Пин Ап казино предоставляет новым участникам бонусный счет, который позволяет познакомиться с возможностями. Бонусная программа, внешний вид сайта, условия игры все время совершенствуются. На главной странице расположена навигационная панель, которая позволяет быстро совершать переход из одного раздела в другой.

Молодой оператор в любой момент предлагает бетторам несколько фрибетов: приветственный бонус в 30 000 рублей с простыми правилами отыгрыша, бонус на экспресс, страховка на проигрыш денег, призовые за правильный ответ на вопросы букмекера, задаваемые в рамках популярных видов спорта (футбол, хоккей, теннис, баскетбол). Периодически Pin UP ru присылает в Личный кабинет пользователя эксклюзивные бонусные предложения.

Легальный букмекер Пин Ап начал свою работу в 2020 году. Владелец – компания «Уильям Хилл». Разрешительные документы № 28 выданы .

• Высокие коэффициенты и широкая линия на десятки тысяч спортивных и киберспортивных событий в прематче и live. От футбола до крикета, от баскетбола до CS:GO — каждый найдёт дисциплину и маркет по душе;

• Моментальный расчёт ставок и быстрые выплаты выигрышей удобными платёжными средствами (VISA, MasterCard, балансы мобильных телефонов);

• Разнообразные бонусы, персональные предложения и программа лояльности для зарегистрированных клиентов;

• Вежливая и компетентная поддержка стремится решить проблему раньше, чем вы сумеете её описать;

• Современная и быстрая платформа с такими эксклюзивными возможностями, как редактирование и выкуп ставки.

Конечно же, мы подаем еду в классическом стиле паба. Еда, которая не требует много столовых приборов и тарелок, но еда, которая просто и хорошо дополняет все наши напитки. Морепродукты и рыба, паста, пивные снэки, сморреброды и брускетты, бургеры, мясо, сыр, и десерты. Мы самостоятельно делаем большую часть того, что вы видите в нашем меню, и подчеркиваем, что еда имеет такое же высокое качество, как и пиво, вино и другие напитки, включенные в наш ассортимент.

Бездепозитный бонус. Это акция, которая дает бесплатные вращения и деньги на счет.

Читайте другие статьи, похожие на Ставка На Спорт Пин Ап Регистрация Скачать ищут:

- Pin Up Ставка Пин Ап

- Пин Ап Ставки Официальное

- Pin Up Как Сделать Ставку Win

- Пин Ап Букмекерская Войти

- Pinup Ставки

- Пин Ап Лига Ставок