Горячая линия Пин Ап

Pin-Up – одна из интересных и популярных БК на российском рынке. Компания радовала игроков качественными услугами, включая клиентскую поддержку. Владелец букмекерской конторы решил покинуть российский рынок, но у некоторых клиентов еще есть необходимость в помощи службы поддержки Pin Up. Бетру расскажет, как игроки могли обращаться с вопросами в саппорт букмекера.

Способы связи со службой поддержки Пин Ап

Звонки на номер горячей линии Пин Ап были одним из удобных способов обращения за помощью в техподдержку БК, несмотря на то, что компания не размещала его на самом видном месте. Для связи с суппортом были доступны и другие способы, некоторые из них можно было посмотреть на сайте во вкладке «наши контакты»:

- живой чат;

- e-mail;

- социальные веб-платформы.

Связаться с суппортом можно было в любое время, специалисты отвечали на вопросы круглосуточно. Время, когда игрок получал удовлетворяющие его ответы зависело от сложности проблемы. Все способы обращения в техподдержку были доступны и не зарегистрированным игрокам.

В БК Pin-Up был также доступен раздел FAQ.

В нем размещались ответы на самые распространенные вопросы. Информация носила консультативный характер и не решала индивидуальные проблемы.

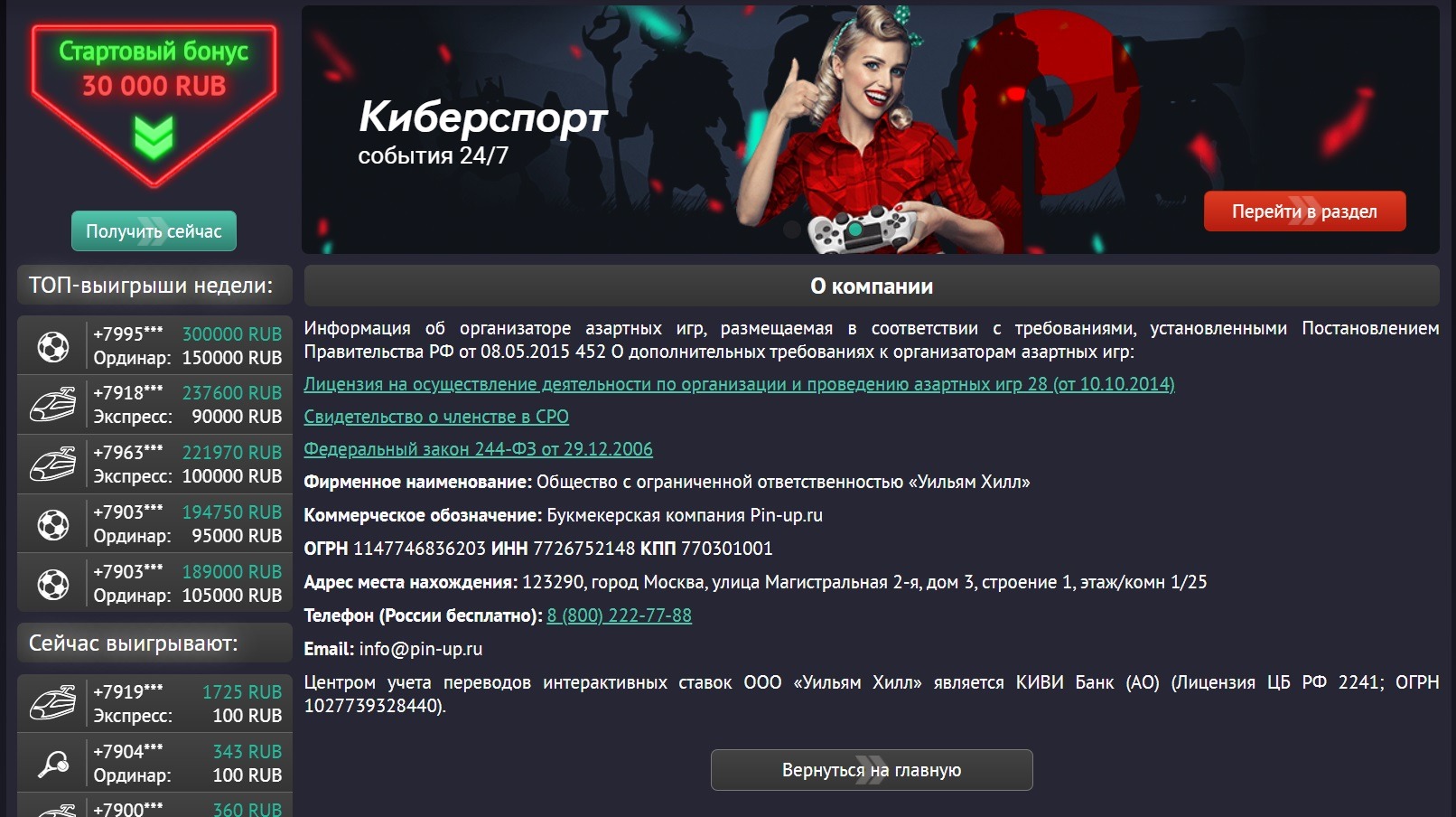

Официальный номер Пин Ап

Звонки на горячую линию принимались круглосуточно. Официальный номер Пин Ап 8 800 77 88 размещался на сайте со всей юридической информацией в разделе «о компании». В контактном центре работало достаточное количество сотрудников, среднее время ожидания ответа составляло 5-7 минут. Звонки с телефонов всех операторов России бесплатные.

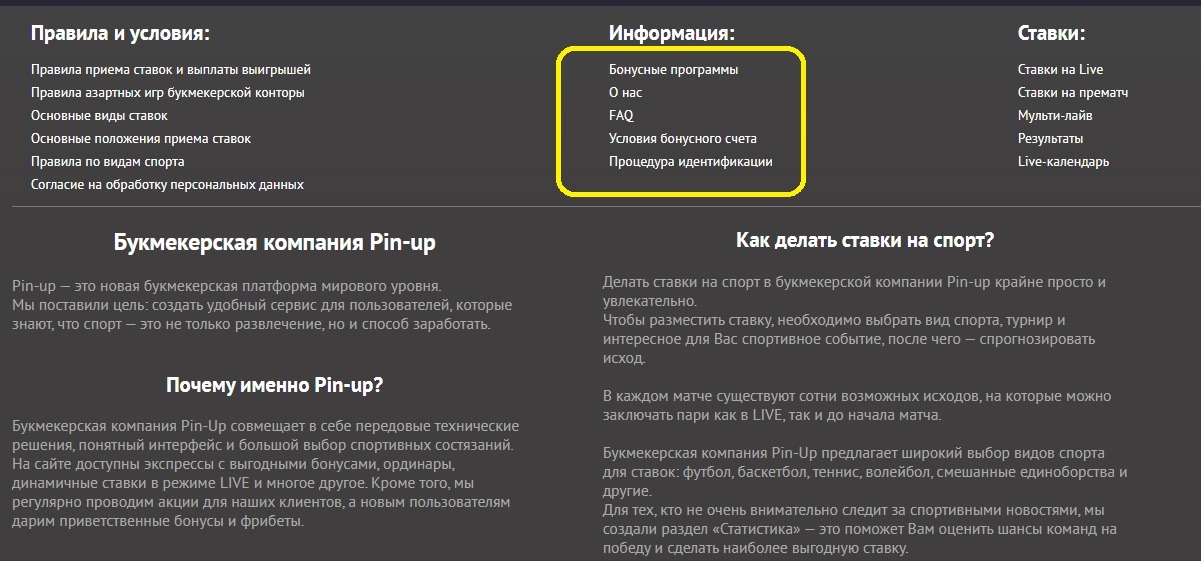

Переход в раздел «Контакты» находился в нижней части сайта

Чат службы поддержки Pin-Up

Живой чат – самый удобный способ обращения в суппорт. Значок, открывающий диалоговое окно был доступен на любой странице букмекерского ресурса. Написать в чат можно было не только на сайте, но и в приложении. В окне требовалось указать имя, описать проблему, нажать «начать диалог». При обращении зарегистрированного в БК пользователя, сотрудник мог попросить предоставить дополнительную информацию, например, контакты или ID. Информация помогала решить проблему более быстро. Среднее время отклика составляло 5-7 сек., при большой нагрузке увеличивалось до 20 сек.

После завершения диалога игрок мог оценить работу специалиста, отметив количество звезд.

Чат для связи с онлайн-консультантом

Электронная почта техподдержки Пин ап

Игроки могли отправить электронное письмо info@pin-up.ru. Адрес пользователи знали сразу после регистрации – букмекер с него отсылал приветственное сообщение на указанную игроком почту. Суппорт рассматривал сообщения по мере их поступления. Игроки получали ответы в течение 24 часов. К тексту можно было приложить скриншоты, фото, которые помогали решить проблемы, например, с выплатами, работой сайта или приложения, идентификацией.

Отправленные письма онлайн на support@pin up team попадают в суппорт другой БК Pin-Up, работающей по оффшорной лицензии, юридически н связанной с российским букмекером с аналогичным названием.

Социальные сети и мессенджеры поддержки Pin-Up

У букмекерской конторы были свои группы и каналы на различных социальных платформах. Через них игроки могли обратиться в службу поддержки Пин Ап с любым вопросом, касательно деятельности компании. Полный список соцсетей и мессенджеров включал:

- ВКонтакте;

- Фейсбук;

- Инстаграмм;

- Одноклассники;

- В Телеграмм были доступны канал и чат.

Ссылки для перехода на соц. платформы размещались в нижней части сайта, достаточно было выбрать подходящий вариант и нажать на него. Письма можно было отправлять через специальную форму. Сотрудники суппорта рассматривали их в максимально короткие сроки, в среднем ответы поступали в течение 10 мин.

Служба поддержки Pin Up в приложении

В мобильном приложении БК доступен весь функционал, предлагаемый на десктопе. Беттеры, играющие через мобильный софт, могли обратиться в support Pin Up всеми способами, доступными на официальном сайте, включай живой чат. Доступные способы связи размещались в меню в разделе «информация». Время отклика в чате, такое же, как при обращении через сайт.

Вывод

Хорошо организованная клиентская поддержка указывает то, что букмекерская контора уважает игроков. БК Пин Ап предлагала несколько способов связи, по любому из них специалисты давали быстрые и исчерпывающие ответы.

FAQ

Работает ли горячая линия Пин Ап круглосуточно?

Саппорт работал в режиме 24/7. Звонки и сообщения принимались в порядке очереди. Сейчас букмекер закрыт.

Какой способ связи со службой поддержки Пин Ап самый быстрый?

Чат не только быстрый, но и удобный способ решения большинства проблем. Кроме текста пользователи могли прикрепить файл.

Какие вопросы помогает решить техподдержка Пин Ап?

Суппорт дает ответы на вопросы о регистрации, ставках (правила заключения пари и расчет), выплатах и прочих услугах, предоставляемых букмекером.

Как сейчас позвонить в службу поддержки из России?

Телефон службы поддержки Пин Ап не работает, других способов дозвониться в БК нет.

Сайт букмекера PIN-UP.KZ доступен в двух языковых версиях — на казахском и на русском — как в мобильной, так и в десктоп-версии. На ресурсе работает круглосуточный чат службы поддержки, миссия которого — решить любую проблему клиентов.

Приложение также позволяет делать экспресс ставки, то есть объединять несколько ставок в одну. В этом случае происходит умножение коэффициентов объединенных ординаров. В случае положительного результата всех событий, выигрыш будет с увеличенным коэффициентом.

Букмекерская контора Pin-up.ru старается создать комфортные условия для своих клиентов. Букмекер дает возможность отредактировать уже совершенные пари. Предложение доступно только полноправным членам конторы.

Так, например, сейчас очень многие люди подключаются к онлайн-казино, которые действительно делают повседневность очень и очень разнообразной, которые позволяют расслабляться, которые создают особую атмосферу и приносят массу позитивных впечатлений. Также стоит сказать, что самих по себе таких игровых клубов на данный момент представлено достаточное количество, но необходимо учесть, что среди них есть лучшие, в частности к ним можно отнести казино Пин Ап www.epinup.org, ведь оно предоставляет массу интересных и выгодных предложений.

Приложение Pin up является официальным — разработка одноименной компании букмекера. Программа позволяет делать различного рода ставки, чтобы получить для себя выгоду.

Pin Up win — это популярное казино, где можно играть в любимые игры и выигрывать реальные деньги. Козина Пинап Casino Pin Up official site — это еще одно зеркало, где доступны все игры и ставки.

Не возможно зайти, с кодом проблемы, хотя раньше заходил, и нет номера телефона для связи , а в pin-ap.com есть. Значит pin-up шулер

Получите доступ к эксклюзивному контенту, специальным предложениям и узнавайте о предстоящих апдейтах и ивентах первыми!